When it comes to choosing a health insurance plan under the Affordable Care Act (ACA), understanding the different tiers is essential. The ACA health plans are often referred to as ‘metal’ tiers due to the use of bronze, silver, gold, and platinum designations. Each tier offers different coverage levels and cost-sharing arrangements. In this comprehensive guide, we’ll delve into the specifics of each tier, helping you make an informed decision about the best ACA health plan for your needs.

What should I know before I pick an ACA insurance plan?

Deciding on the most suitable health insurance plan can present challenges. It’s essential to evaluate your household budget for the coverage year ahead.

Take into account the expected extent of healthcare usage and whether any covered individuals require regular prescription medications. If you anticipate limited medical needs, a bronze plan might be a prudent choice. Opting for a silver plan is necessary to access assistance with out-of-pocket expenses. For those anticipating frequent doctor visits and prescribed medications, selecting a gold or platinum plan could be advisable.

There are three primary areas to familiarize yourself with before finalizing your decision:

Understanding the Four Metal Categories: Grasping the distinctions in cost-sharing among these plans can aid in making an informed choice for both yourself and your family. The metal categories categorize expenses based on varying levels of out-of-pocket costs. It’s important to note that these tiers do not correlate with the quality of care.

Total Healthcare Costs: An insurance plan entails a monthly premium alongside out-of-pocket expenses when healthcare services are required. The premium constitutes your monthly payment to the insurance provider, regardless of whether you utilize medical services. When receiving care, additional out-of-pocket expenses or cost-sharing might apply. These expenses encompass deductibles, copayments, and coinsurance.

Plan Types and Networks: Conduct thorough research and comparisons. Different plans offer distinct benefits. While some plans grant the flexibility to see virtually any doctor anywhere, others mandate the selection of in-network providers and facilities to avoid extra charges. Opt for plans that provide the specific benefits you need. If you have preferred healthcare providers, ensure they are in-network for the plan you choose. While the metal categories do not reflect care quality, individual plans might carry varying quality ratings.

What are the four “metal” tiers?

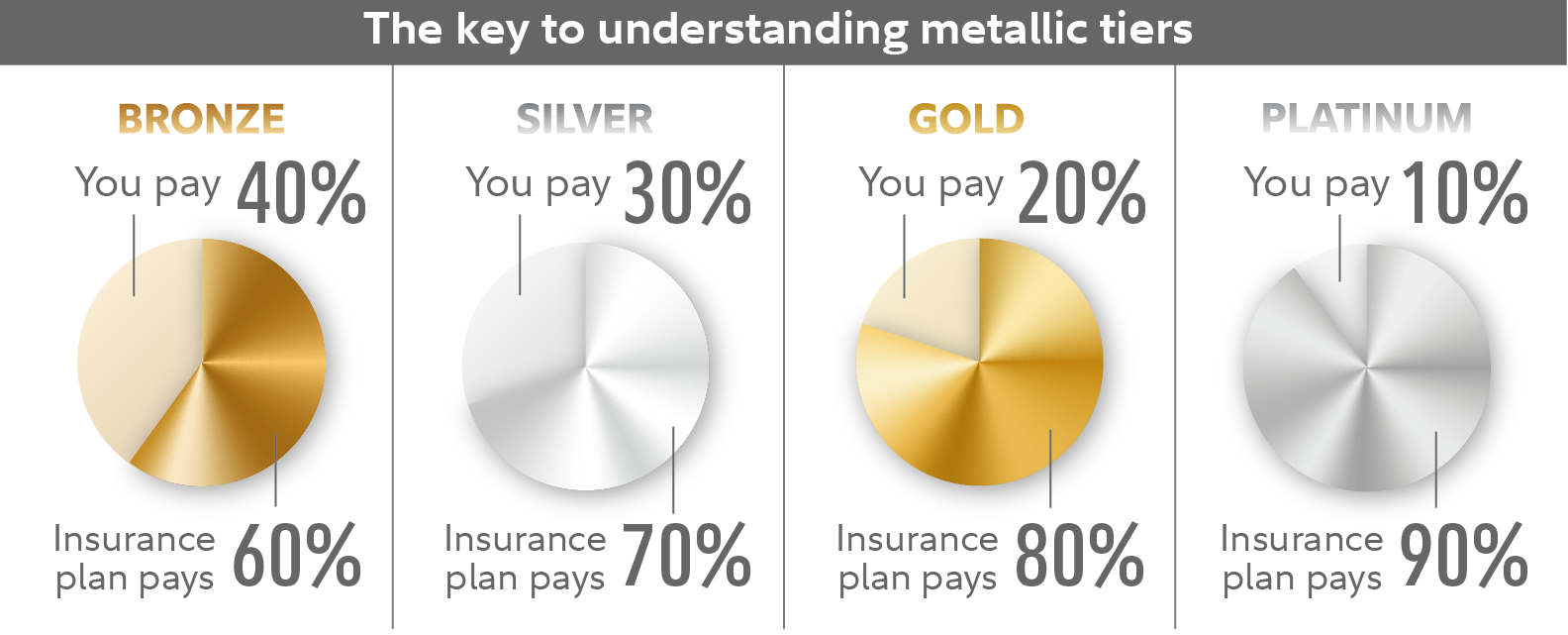

ACA health plans are categorized into different “metal tiers,” dictating the cost-sharing arrangement between you and your plan when it comes to medical expenses. These metal tier classifications encompass:

- Bronze Tier: This tier offers the lowest monthly premium but comes with higher expenses when you require medical attention.

- Silver Tier: Referred to as the “benchmark” plan, it features moderate monthly premiums and intermediate costs for medical care. Opting for a silver plan is essential to access cost-sharing reductions, which translate to “extra savings” on out-of-pocket expenses like deductibles, copayments, and coinsurance.

- Gold Tier: While entailing a higher monthly premium, the gold tier boasts lower costs for medical services.

- Platinum Tier: This tier carries the highest monthly premium yet provides the lowest expenses when medical care is needed.

What are the costs of each health plan?

Each health plan you consider will come with a monthly premium, which has become remarkably affordable in the 2023 coverage year due to the American Rescue Plan Act of 2021 and the Inflation Reduction Act of 2022. These legislative actions have introduced new financial assistance for premiums, making it possible for 4 out of 5 individuals to discover plans priced at $10 or less per month.

If you qualify for the premium tax credit, also recognized as a premium subsidy, this financial support will decrease your monthly bill.

According to a comprehensive analysis by the Kaiser Family Foundation, focusing on marketplace plans for a 40-year-old individual, the average premium for a silver plan in 2023 stands at $456 (without subsidies). However, this figure varies, ranging from $323 in New Hampshire to $841 in Vermont.

The complete expenses tied to each plan hinge on the type of plan you opt for and the extent of healthcare you utilize. Your monthly premium for the coverage year remains consistent, unless a qualifying life event prompts a change. Beyond the monthly premium, additional out-of-pocket expenses come into play:

- Deductible: This amount must be covered by you before the insurance coverage commences, except for preventive health services. Routine care, including checkups and screenings within your plan’s network, is accessible without incurring a deductible or other out-of-pocket costs.

- Copayments and Coinsurance: These payments might be required each time you avail a service, excluding preventive health services. A copayment, or copay, is a predetermined sum you pay after fulfilling your deductible. On the other hand, coinsurance represents a percentage of the cost of a covered health service after the deductible has been met.

- Out-of-Pocket Maximum: Also termed the out-of-pocket limit, this constitutes the highest amount you need to pay for covered services within a plan year. After you’ve met your deductible, copayments, and coinsurance up to this threshold, the insurance company covers 100% of all covered services for the remainder of the plan year. In 2023, the out-of-pocket maximum for marketplace plans is $9,100 for individuals and $18,200 for families.

Understanding Catastrophic Health Plans

Catastrophic health plans cater to individuals seeking financial protection against substantial medical expenses in the event of a severe illness. These plans feature notably low premium costs; however, the deductibles—initial payments borne by you before your benefits take effect—are exceptionally high. For the year 2023, ACA catastrophic health plans will carry an annual deductible of $9,100 for individuals. Importantly, these plans extend coverage to preventive health services without necessitating the fulfillment of a deductible.

Catastrophic plans are exclusively available to individuals under the age of 30, or individuals of any age who possess a hardship exemption. Such an exemption could encompass a variety of situations, including:

- Affordability exemptions for marketplace premiums or job-based insurance that prove prohibitively expensive for your budget.

- Circumstances such as homelessness, eviction or the threat of eviction, foreclosure, domestic violence, and enduring the effects of a natural or human-made disaster—such as fire or flood—that have inflicted substantial damage upon your property.

- Receiving a shut-off notice from a utility company or grappling with the aftermath of a family member’s death.

- Navigating bankruptcy proceedings.

Ready to start a plan? Call us (971) 233-3637. Our assistance is at no cost to you.