Medicare Part A, the hospital insurance component of Medicare, is usually provided without a premium and covers hospital care and related services. Here’s what you need to know about the coverage and expenses associated with Part A.

What Medicare Part A covers?

Inpatient hospital care: Part A covers hospital services when you’re admitted on a doctor’s orders. This includes semi-private rooms, meals, general nursing, and drugs for inpatient treatments. However, costs for services not covered by Part A, such as a private room or a private-duty nurse, must be paid for out of pocket. If you require mental health treatment in a psychiatric hospital, Part A also provides coverage for a limited number of days (up to 190 days over your lifetime). Most hospitals accept Medicare, but Veterans Affairs and military hospitals usually do not accept it.

Skilled nursing facility care: After a qualifying inpatient hospital stay of at least three days, Part A covers short-term care at a certified skilled nursing facility. This includes a semi-private room, meals, skilled nursing care, and necessary therapy. Other wellness services, such as speech-language pathology, medical social services, medications, and medical supplies/equipment used in the facility, are also covered. However, services recommended by your medical team that are outside the scope of Part A would be your responsibility.

Hospice benefits: Medicare Part A covers all costs related to hospice care for terminally ill individuals. This includes support care, pain medications, symptom management, grief and loss counseling, and respite care for the main caregiver.

Home health services: Part A covers certain healthcare services provided in your home if you are homebound and receive approval from a doctor. Covered services include part-time skilled nursing, home health aide care, therapy (occupational, physical, speech-language pathology), medical social services, and injectable osteoporosis drugs for women. However, Part A does not cover 24-hour care, meal delivery, homemaker services, or personal care like bathing or dressing, unless other qualifying care is needed.

How much does Medicare Part A cost?

If you or your spouse has worked and paid Medicare taxes for at least 10 years (or 40 quarters), you qualify for premium-free Part A. Otherwise, you may be eligible to purchase Part A coverage, which can have a premium of up to $506 per month in 2023, depending on your work and Medicare tax history. Although the premiums can be expensive, it is recommended to consider paying for Part A if you can afford it, as it complements Original Medicare and can be supplemented with Medigap plans.

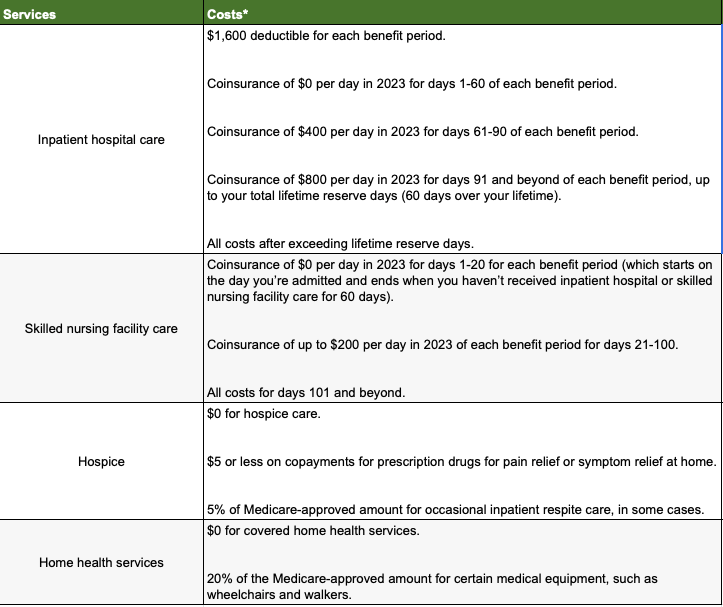

In addition to premiums, other costs may apply based on your healthcare usage. The table below summarizes your share of costs for hospital or skilled nursing care. Depending on your specific Medigap plan or Medicare Advantage policy, these costs may be covered by your insurance.

Medicare Part A Eligibility

You are generally eligible for Medicare Part A if you meet any of the following criteria:

- being age 65 or older,

- receiving disability benefits from Social Security or the Railroad Retirement Board for 24 months,

- receiving disability benefits due to Amyotrophic Lateral Sclerosis (ALS) or Lou Gehrig’s disease,

- or having end-stage renal disease and meeting certain requirements.

Ready to start a plan? Call us (971) 233-3637. Our assistance is at no cost to you.