Medicare

Medicare aims to offer affordable and comprehensive health coverage to individuals aged 65 and older, as well as younger people with certain disabilities or specific medical conditions.

Understanding the intricacies of Medicare can be complex due to its various parts and coverage options. We can help you navigate the Medicare landscape, make informed decisions about your coverage, and find the plan that suits you healthcare needs and budget.

-

Prescription Drug Coverage

-

Rides To Appointments

-

Dental, Vision & Hearing Plans

-

No Contact Dr’s Appointments

-

And Much More

Why Change Your Medicare Plan?

Each year, Medicare plans undergo changes, which may include changes in the coverage of prescriptions. Our team of licensed, experienced, and committed Medicare professionals is here to assist you in navigating through these changes. We will ensure that you understand your options thoroughly and help you access all the benefits you are entitled to, while keeping your costs at a minimum.

Medicare and its Four Parts

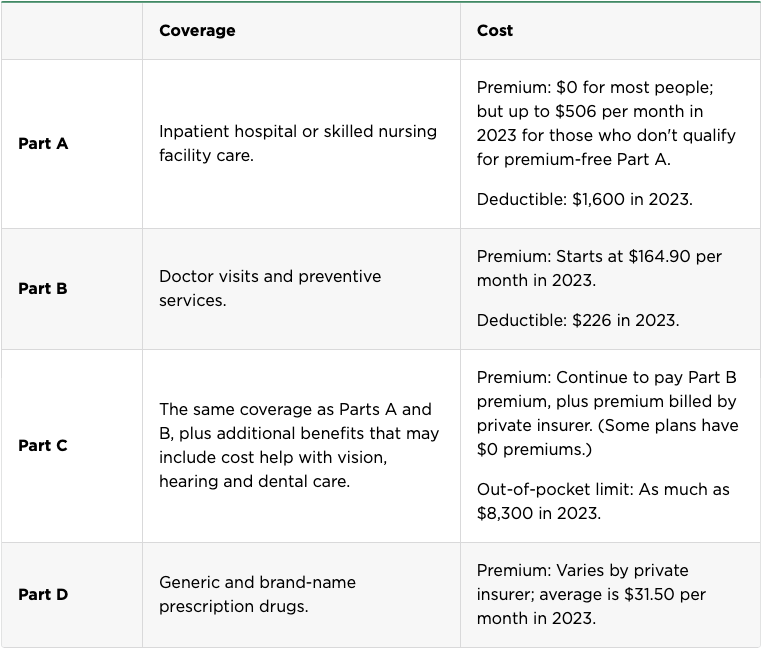

Medicare is a health insurance program that comprises four distinct parts, namely Part A, Part B, Part C, and Part D. Each part provides specific coverage and has varying costs. Here’s a breakdown of what each part covers:

- Part A: This covers hospital care and related services.

- Part B: This covers medical care that’s received outside of a hospital, such as doctor appointments and outpatient services.

- Part C: Also known as Medicare Advantage, this part covers the same benefits as Parts A and B but is offered by private insurers.

- Part D: This part specifically covers prescription drugs.

of Oregon Residents are enrolled in Medicare

Of the 909,000 Medicare beneficiaries in Oregon are under age 65.

Medicare Part A

Part A covers hospital care and related inpatient services, such as:

- Inpatient hospital stays

- Skilled nursing facility care

- Hospice care

- Home health care (limited to skilled nursing care, physical therapy, occupational therapy, and speech-language pathology services)

It’s important to note that while Part A covers these services, there may be certain deductibles, copayments, or coinsurance amounts that the patient will be responsible for paying

Medicare Part B

Part B covers a wide range of medical services and supplies that are medically necessary to diagnose or treat a medical condition. These services include:

- Doctor visits and consultations

- Preventive services such as vaccinations, mammograms, and prostate exams

- Diagnostic tests such as blood tests, X-rays, and MRIs

- Outpatient medical and surgical procedures

- Ambulance services

- Durable medical equipment (DME) such as wheelchairs, walkers, and oxygen equipment

- Physical and occupational therapy

- Some mental health services

As with Part A, there may be certain deductibles, copayments, or coinsurance amounts that the patient will be responsible for paying.

Medicare Part C

Part C, also known as Medicare Advantage, covers all the services that are provided under Part A and Part B, but it is offered by private insurance companies approved by Medicare. In addition to the services covered under Parts A and B, Medicare Advantage plans may also include coverage for:

- Prescription drug coverage (Part D)

- Routine vision, dental, and hearing services

- Health and wellness programs, such as gym memberships and nutrition counseling

- Transportation to medical appointments

- Home health care services

- Some plans may offer coverage for services that are not covered by Parts A and B, such as acupuncture or chiropractic care.

It’s important to note that the availability and extent of coverage may vary depending on the specific Medicare Advantage plan chosen.

Medicare Part D

Part D provides coverage for prescription drugs. This coverage is provided by private insurance companies that are approved by Medicare. Part D helps pay for the cost of prescription drugs, including:

- Brand-name and generic drugs

- Specialty drugs

- Injectable drugs

- Vaccines

- Insulin

- Some plans may also cover over-the-counter drugs with a doctor’s prescription

It’s important to note that each Part D plan has its own list of covered drugs, called a formulary. The cost of drugs and the amount of coverage can also vary depending on the plan chosen.

Medigap

Medicare Supplement plans, also known as Medigap, provide an additional coverage option to Original Medicare by covering the costs that are not covered by Part A and Part B. Original Medicare only covers 80 percent of medical costs, leaving the remaining 20 percent as coinsurance or copayments, along with some other out-of-pocket expenses.

A Medigap plan can cover these costs, such as

- coinsurance,

- copayments, and

- deductibles.

Medigap policies are sold by private insurance companies and cannot be paired with Medicare Advantage plans. It’s important to note that Medigap is designed to work with Original Medicare and not with Medicare Advantage.

Who is eligible for Medicare?

To be eligible for Medicare, you must meet certain criteria.

- If you are a U.S. citizen or a permanent legal resident for the past five years and are at least 65 years old, you are entitled to Medicare.

- Additionally, Medicare also covers some individuals who are under 65 and have a disability.

- Those who receive Social Security disability insurance typically become eligible for Medicare after a two-year waiting period.

- However, those with end-stage renal disease (permanent kidney failure) are automatically enrolled upon signing up, and individuals with amyotrophic lateral sclerosis (ALS, also known as Lou Gehrig’s disease) are eligible in the month that their disability begins.

Medicare Costs and Coverage

Medicare comes with certain costs and fees that beneficiaries should be aware of. These may include premiums, deductibles, coinsurance, and potential penalties for delaying enrollment in Medicare Part B.

For Medicare Part A, most individuals do not have to pay a premium as they have already paid for it through years of payroll taxes while working. It’s important to understand key terms related to Medicare costs, including:

- Premium: the monthly payment made in exchange for coverage

- Deductible: the amount you are responsible for paying for medical care or prescriptions before Medicare Part A, Part B, Part D, or your Medicare Advantage plan begins to pay

- Coinsurance: a percentage of the bill that you may be required to pay for your share of medical services after paying any deductibles

- Lifetime Reserve Day: additional days that Medicare pays for when you are in a hospital for more than 90 days. You have a total of 60 of these for your entire lifetime. Medicare covers all costs, except for coinsurance, for each of these days that you use.

Out-of-Pocket Medicare Costs in 2023

Medicare Enrollment Periods

Medicare has several enrollment periods, including:

Initial Enrollment Period (IEP): This is the seven-month period that begins three months before your 65th birthday month and ends three months after your birthday month. If you are eligible for Medicare due to a disability, your IEP will begin three months before your 25th month of disability and end three months after that month.

General Enrollment Period (GEP): This period runs from January 1 to March 31 each year, and is for people who didn’t sign up for Medicare during their IEP. However, if you sign up during the GEP, your coverage won’t start until July 1 of that year.

Special Enrollment Period (SEP): This is a period during which you can enroll in Medicare or make changes to your coverage outside of the IEP or GEP. For example, if you lose your job and the health insurance that came with it, you may be eligible for an SEP.

Annual Enrollment Period (AEP): This period runs from October 15 to December 7 each year, and is when you can make changes to your coverage for the following year. If you have Medicare Advantage, you can also make changes during the Medicare Advantage Open Enrollment Period from January 1 to March 31 each year.

It’s important to enroll during your IEP to avoid any late enrollment penalties or gaps in coverage. Learn more about Medicare Enrollment Periods here.

Frequently asked questions

1. Who qualifies for Medicare?

In general, Medicare eligibility applies to those who are 65 years of age or older, or those who are younger but have a disability and receive Social Security disability insurance. Additionally, individuals who have end-stage renal disease (ESRD) or ALS (amyotrophic lateral sclerosis) are also eligible for Medicare coverage.

2. Do I need Medicare if I have health insurance?

The eligibility and enrollment process can vary depending on several factors. For instance, if you have health coverage through your own or your spouse’s employer, the size of the employer will determine whether or not you need to enroll in Medicare Part A and Part B immediately. If your employer has less than 20 employees, it is advisable to sign up for both parts as soon as you’re eligible. Doing so will cover your healthcare expenses that your other plan may not pay. However, if your employer has 20 or more employees and you have group health coverage, you may be able to delay enrolling without penalty. In such a case, it’s recommended that you consult with your benefits manager to determine the best course of action.

If you have individual health insurance through the marketplace or any other private insurance, and you’re eligible for premium-free Part A, you should enroll in both Part A and Part B when you become eligible. However, if you’re not eligible for premium-free Part A, you may choose to keep your current individual coverage which could be less expensive.

It’s important to note that delaying enrollment in Part A or Part B when you first become eligible may result in late enrollment penalties that could last for your entire retirement period. If you choose to delay enrolling in Part A when first eligible, the penalties will apply for a specific period of time.

3. Does Medicare cover dental and eye care?

The majority of dental care and procedures such as fillings, cleanings, dentures, tooth extractions, and dental plates are not covered by Original Medicare. Nevertheless, certain dental services you obtain in a hospital that are necessary for another operation or surgery may be covered by Medicare Part A (hospital insurance). Eye examinations for eyeglasses or contact lenses are not included in Medicare coverage either. However, some Medicare Advantage Plans (Part C) may provide additional benefits, including partial coverage for dental, vision, and hearing services.

The Bottom Line

Medicare is a federal health insurance program that provides coverage to people who are 65 years or older, people with certain disabilities, and people with End-Stage Renal Disease (ESRD). Medicare covers a wide range of medical services, including hospital stays, doctor visits, and prescription drugs.

Medicare has four parts: Part A, Part B, Part C (also known as Medicare Advantage), and Part D. Each part covers specific healthcare services, and beneficiaries can choose to enroll in different parts depending on their needs. Medicare Advantage plans are an alternative to Original Medicare and offer additional benefits such as vision, hearing, and dental coverage.

While Medicare provides essential health coverage, it’s important to understand the different parts and coverage options, as well as the associated costs. Premiums, deductibles, and copayments can vary significantly across plans, and beneficiaries should carefully consider their options to find the best plan for their needs and budget.