The Premium Tax Credit: Understanding How It Works under the Affordable Care Act (ACA)

The ACA played a significant role in introducing tax subsidies, such as the premium tax credit (PTC), which has helped individuals and families save money on health insurance.

To be eligible for this credit, individuals must enroll in ACA coverage through a state health insurance exchange or the HealthCare.gov marketplace.

So, how does the premium tax credit work exactly?

If you qualify, it can either reduce your tax bill or increase the amount of your tax refund.

Typically, individuals have to wait until they file their tax returns to access any eligible tax benefits. However, this is not the case with the premium tax credit. Those who qualify can receive the benefits during the year.

The marketplace will send advance payments of the premium tax credit (APTC) directly to your health insurance company. This results in a lower monthly premium, significantly reducing your out-of-pocket insurance costs.

What factors influence the amount of the premium tax credit you can claim?

While it aims to make health insurance more accessible and affordable, the credit amount varies among individuals and can fluctuate from year to year. Several factors determine the credit amount, including:

- Estimated income

- Household size

- Place of residence

A higher premium tax credit translates to more savings, but it is essential to fulfill income reporting requirements. When applying for ACA marketplace coverage, you will have the opportunity to estimate your income, and this information will determine your premium tax credit.

Who is eligible for the premium tax credit?

As mentioned earlier, you must have health insurance through the marketplace to qualify. You can include family members in your enrollment, but plans purchased outside the marketplace are not eligible for the credit.

Here are some additional qualifications:

- You cannot be claimed as a dependent on someone else’s tax return.

- Your tax filing status cannot be “married filing separately,” with certain exceptions for survivors of domestic abuse or spousal abandonment.

- You do not have qualifying health coverage through Medicare or Medicaid.

- You do not have access to affordable health insurance coverage through a qualified workplace plan.

- You meet the income requirements.

Even if you qualify for the premium tax credit, the amount may change based on income fluctuations. It is crucial to stay updated on income reporting and report any increases to determine your actual eligibility for the credit.

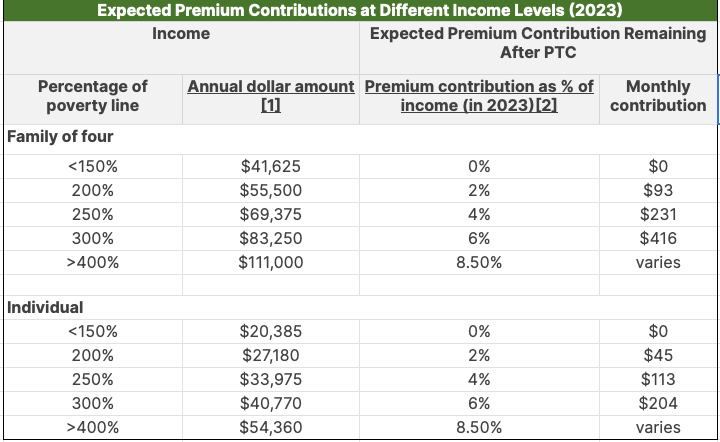

Under the ACA, household incomes had to fall between 100% and 400% of the federal poverty level, depending on household size, to qualify. The lower the household income, the higher the premium credit.

When Will You Receive Your Tax Credit?

You have two options for receiving your premium tax credit. One option is to defer the benefits until tax time. When you file your tax returns, you will receive the full amount of the credit you qualify for. Since it is refundable, you may be eligible for a tax refund at the end of the year.

Alternatively, you can choose to receive advance payments of the APTC throughout the year. The government will make monthly payments to your insurance company on your behalf, reducing your out-of-pocket costs for insurance premiums. However, you will be responsible for paying the remaining amount of the insurance bill that is not covered by the advance payments.

Will You Still Owe Money at Tax Time?

If you opt for advance payments of the premium tax credit, there are a few considerations to keep in mind. Your projected income determines the amount of your credit. If your income changes during the year, this can create complications when it comes to tax time.

For example, if you take on a side gig as a freelance writer and your income fluctuates from month to month, you may end up earning more money than you initially projected. As a result, you may have to repay a portion or all of your credit at the end of the year.

It’s crucial to report any life changes promptly, as they can impact the amount you are eligible for. Here are a few life events that should be reported immediately:

- Change of residence

- Marriage or divorce

- Birth or adoption

- Death

- Offer to receive workplace insurance coverage

- Enrolling in Medicare or Medicaid

Reporting these changes promptly helps avoid unexpected tax bills. Failure to act promptly may result in having to repay excess premium tax credit received throughout the year.

Does the Premium Tax Credit Apply to All Types of Insurance?

The premium tax credit is available to individuals with ACA health insurance purchased through the HealthCare.gov website or state marketplaces.

Insurance coverage obtained outside the marketplace does not qualify. If you have affordable health insurance through your job, you cannot claim the credit.

Additionally, the following types of insurance do not qualify for the premium tax credit:

- Premium-free Medicare Part A

- Medicaid

- Children’s Health Insurance Program (CHIP)

The Bottom Line

In conclusion, taking advantage of a tax credit can significantly reduce your monthly premium expenses and provide substantial savings. By researching, understanding eligibility requirements, and following the necessary procedures to claim the credit, you can effectively lower your financial burden while maintaining essential insurance coverage. Remember to stay informed about changes in tax laws and consult with a tax professional to ensure you maximize your savings opportunities. Saving on monthly premiums through credits can contribute to financial well-being and provide peace of mind regarding your insurance coverage.