Medicare takes precedence as the primary coverage when it is your sole form of insurance. However, when you have additional insurance, a predetermined coordination of benefits is applied to determine which coverage is primary and which is secondary.

As their names imply, the primary coverage takes priority in payment, while the secondary coverage pays after that. Whether Medicare serves as the primary or secondary coverage, it still provides valuable benefits to seniors. The benefits you receive depend on which coverage is responsible for healthcare expenses first. In the following sections, we will discuss situations where Medicare acts as the primary or secondary coverage, as well as cases where no coordination of benefits exists.

Other types of insurance

There exist various types of health insurance plans. If you’re becoming eligible for Medicare but already have insurance, it’s important to understand how your current plan coordinates with Medicare and whether you can delay enrolling in Medicare.

- Job-based insurance: This refers to insurance provided by an employer or union for their current employees. If you’re covered by your own job-based insurance or your spouse’s (or sometimes a family member’s) plan, it may work in conjunction with Medicare to cover your healthcare expenses. Depending on the employer’s size, job-based insurance can either be primary or secondary to Medicare. It may also offer the option to postpone Medicare enrollment.

- Retiree insurance: These are insurance plans offered by employers to former employees who have retired. Retiree insurance always functions as secondary coverage to Medicare.

- Federal Employee Health Benefits (FEHB): This insurance is available to current and former government employees and their family members. Whether FEHB acts as primary or secondary coverage depends on whether you are enrolled in Part B of Medicare.

- TRICARE: This is insurance provided by the federal government to active duty and retired military personnel and their families. There are multiple TRICARE programs, but TRICARE for Life, which is for retirees, serves as secondary coverage to Medicare.

- Veterans Affairs (VA) benefits: These are insurance benefits provided by the federal government to veterans, encompassing pensions, educational stipends, healthcare, and more. VA benefits do not coordinate with Medicare.

Is Medicare Primary or Secondary?

When you have both Medicare and another type of insurance, Medicare will assume either a primary or secondary role in covering your medical expenses.

Primary insurance takes the first responsibility for paying your medical bills. Secondary insurance steps in and pays after the primary insurance has contributed. Typically, secondary insurance covers some or all of the remaining costs left after the primary insurer has paid, such as deductibles, copayments, or coinsurances. For instance, if your primary insurance is Original Medicare, your secondary insurance may cover a portion or all of the 20% coinsurance for services covered under Part B. Depending on the coverage and costs of your primary insurer, secondary insurance can be beneficial in reducing your healthcare expenses.

In the event that your primary insurance denies coverage, the secondary insurance may or may not contribute to the cost, depending on the terms of the insurance policy.

If you do not have primary insurance, your secondary insurance might offer minimal or no payment towards your healthcare expenses.

If you are contemplating delaying enrollment in Part B due to existing insurance coverage, it is crucial to inquire about how your insurance works with Medicare from your benefits manager or human resources department. When Medicare assumes the primary role in relation to your current insurance, enrolling in Part B is advisable to avoid incurring high out-of-pocket costs. This is because when Medicare is primary, your other insurance may not cover any costs until Medicare has made its contribution. In such cases, you would be responsible for paying these costs yourself. Conversely, when Medicare is secondary, your current insurance will cover the majority of the costs for services that are eligible.

To confirm how Medicare coordinates with your current insurance, you can reach out to the Social Security Administration (SSA) or Medicare.

When Medicare is primary and secondary

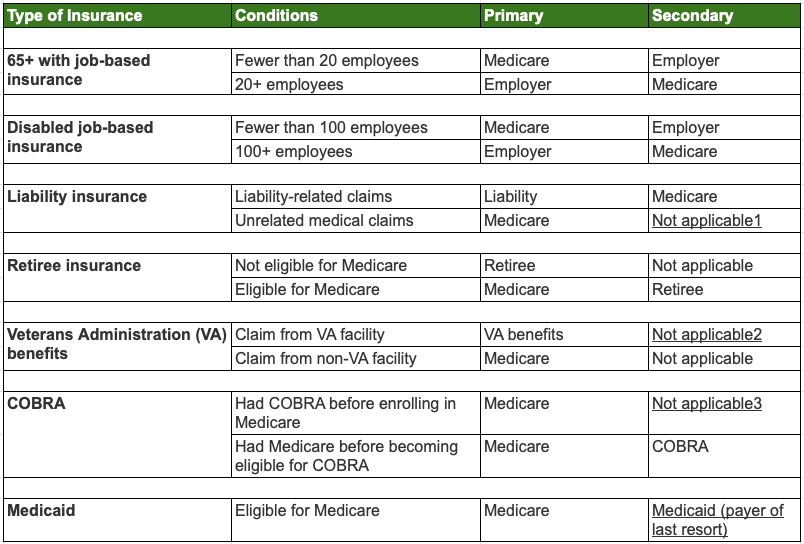

When you have both Medicare and another form of insurance, Medicare assumes the role of either the primary or secondary insurer. Refer to the table provided to understand how Medicare aligns and coordinates with other insurance plans.

FAQS

Is Medicare always the primary insurance when you have additional coverage?

No, Medicare can be either the primary or secondary insurance, depending on the specific circumstances and the type of coverage you have.

How can I determine if Medicare is my primary or secondary insurance?

You can find out by contacting your insurance providers or speaking with your benefits manager or human resources department. They can provide information on the coordination of benefits and the order in which your insurances will pay for medical expenses.

Does Medicare Advantage serve as the primary or secondary insurance?

Once you opt for a Medicare Advantage plan, the responsibility for covering your medical expenses shifts from Medicare to a private insurance carrier. As a result, Medicare is relieved of the obligation to pay your claims. Your Medicare Advantage plan becomes your sole and primary source of coverage.

Conclusion:

Whether Medicare is primary or secondary depends on various factors, including the type of coverage you have and the coordination of benefits with other insurances. It is essential to understand the role of Medicare in relation to your other insurance plans to ensure proper coverage and avoid potential gaps in payment. By contacting your insurance providers or consulting with relevant personnel, you can determine the primary-secondary status of Medicare and make informed decisions regarding your healthcare expenses.

Ready to start a plan? Call us (971) 233-3637. Our assistance is at no cost to you.