Medicare Supplement

Private insurance companies offer Medicare Supplement Insurance, which covers medical expenses that are not included in Medicare. This insurance, commonly referred to as Medigap, assists in paying for out-of-pocket expenses such as copays, coinsurance, and deductibles.

What is a Medicare Supplement Plan?

Medicare Supplement insurance, also called Medigap, is a type of healthcare insurance that can be purchased to assist in covering the out-of-pocket expenses not included in Original Medicare.

Oregon residents enrolled in an Oregon Medicare Supplement plan.

of Oregon's fee-for-service Medicare users also have a Medigap plan.

How does Medigap work?

Although Original Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) cover many healthcare services and supplies, they do not cover all of them. To assist in paying for some of the healthcare costs that Original Medicare doesn’t cover, such as deductibles, coinsurance, and copayments, Medigap plans are available.

It is important to note that Medigap plans are not the same as Medicare Advantage plans. Additionally, a Medigap policy only covers one person, so if you and your spouse both require Medigap coverage, you must purchase separate policies. Medigap policies also do not include prescription drug coverage; you can obtain prescription drug coverage through a Medicare Prescription Drug Plan (Part D).

When you have a Medigap plan, you must pay a monthly premium in addition to the Part B premium from Original Medicare. However, a Medicare Supplement policy is guaranteed renewable, even if you have health problems. This means that as long as you pay the premium and provide accurate information on your application, your private insurance company cannot cancel your policy.

Finally, it is essential to understand that Medigap policies generally do not cover long-term care, vision or dental care, hearing aids, eyeglasses, or private-duty nursing.

What does Medicare Supplement insurance cover?

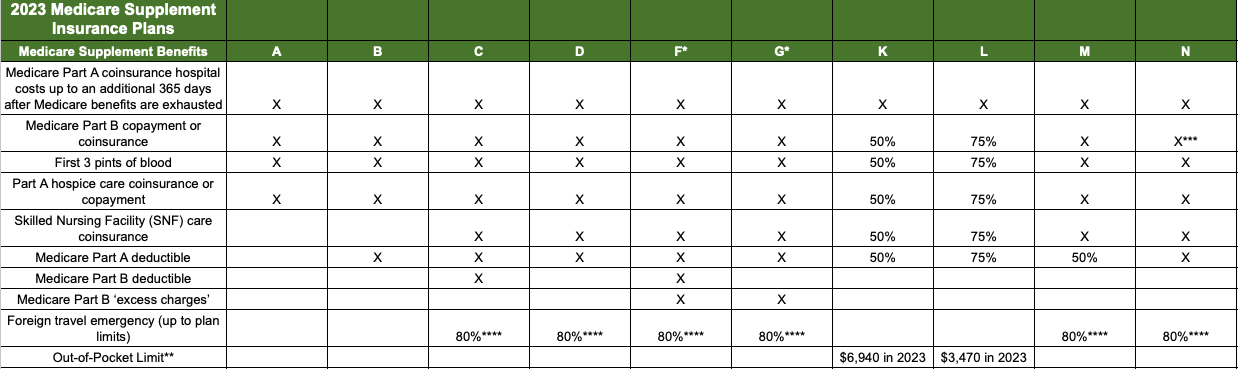

Medicare Supplement insurance plans are designed to assist with costs that Original Medicare does not cover. Each plan offers a variety of benefits, allowing you to select the Medigap plan that best suits your specific requirements.

The basic benefits of Medigap plans typically include coverage for:

- Part A coinsurance and hospital expenses for an additional 365 days following the exhaustion of Medicare benefits

- Part B coinsurance or copayments

- Blood (first 3 pints)

- Part A hospice care coinsurance or copayment

Additional benefits that may be included in certain plans are:

- Coinsurance for skilled nursing facility care

- Part A deductible

- Part B deductible

- Part B excess charges

- Foreign travel exchange (up to a specific plan limit)

- Out-of-pocket limit

What does Medicare Supplement insurance not cover?

Generally, Medigap plans do not provide coverage for:

- Long-term care (such as non-skilled nursing home care)

- Vision or dental services

- Hearing aids

- Eyeglasses

- Private-duty nursing

- Prescription drug coverage

If you require prescription drug coverage, Medicare Part D may be the appropriate solution. You can obtain Medicare Part D prescription drug coverage in two ways: through a stand-alone plan that works alongside Parts A and B, or through a Medicare Advantage Prescription Drug plan (MAPD).

A Medicare Part C plan, also known as Medicare Advantage, may be a suitable choice if you need coverage for other products and services. Like Medicare Supplement plans, most Medicare Advantage plans provide a variety of benefits so you can explore your options and select the plan that best meets your needs.

Who is eligible for a Medigap plan?

In order to purchase a Medicare Supplement plan, you must meet the following requirements:

- Be 65 years of age or older

- Be enrolled in Medicare Parts A and B

- Reside in the state where the plan is available

When is the best time to enroll in a Medigap plan?

You may apply for a Medicare Supplement policy at any time. However, the ideal time to purchase a plan is during your 6-month Medicare Supplement Open Enrollment period.

Your Medicare Supplement Open Enrollment period commences the first month you turn 65 and have Part B coverage. The primary benefit is that you can buy any Medicare Supplement plan offered in your state without answering health-related questions. Even if you have health issues, insurance companies cannot deny you a Medicare Supplement policy and must offer the same price as individuals with good health.

If you apply after your open enrollment period, an insurance company may not sell you a policy unless you are eligible for a guaranteed issue right. If you are under 65 and have Medicare, you may not be able to purchase a Medigap policy or the one you prefer until you reach the age of 65.

How much does Medigap cost?

Each insurance company can set its own premium for Medicare Supplement plans, which can differ across companies for the same coverage.

When shopping for a Medigap policy, make sure to compare the same policy among multiple insurers. For instance, if you are interested in Medigap Plan C, compare the cost of Medigap Plan C from two to three different insurance providers. This will enable you to obtain the best price for the plan you desire.

What are the different types of Medicare Supplement plans?

There are 10 standardized Medigap plans that are available in most states. These plans are labeled Plan A, B, C, D, F, G, K, L, M and N

Frequently Asked Questions

What is a Medicare Supplement plan? A Medicare Supplement plan, also known as Medigap, is a type of health insurance policy that helps pay for the out-of-pocket costs that Original Medicare doesn’t cover, such as copayments, coinsurance, and deductibles.

What benefits do Medicare Supplement plans cover? Medigap cover a range of benefits, including Part A coinsurance and hospital costs, Part B coinsurance or copayment, blood (first 3 pints), and Part A hospice care coinsurance or copayment. Additional benefits, such as skilled nursing facility care coinsurance, Part A and B deductibles, Part B excess charges, foreign travel exchange, and out-of-pocket limit, may also be included in certain plans.

How do I enroll in a Medicare Supplement plan? To enroll in Medigap, you must be 65 years old or older, enrolled in Medicare Parts A and B, and live in the state where the policy you want is offered. The best time to buy a plan is during your 6-month Medicare Supplement Open Enrollment period, which starts the first month you’re both age 65 or older and have Part B.

The Bottom Line:

A Medicare Supplement plan can provide additional coverage to help pay for out-of-pocket healthcare costs that Original Medicare doesn’t cover. The benefits and costs of these plans can vary depending on the insurance company and the state where you live. It’s important to research and compare different plans to find the one that best fits your needs and budget. If you’re considering Medigap, make sure to enroll during your 6-month Medicare Supplement Open Enrollment period to take advantage of the benefits and avoid potential penalties or restrictions.

862 SE Oak Street, Suite 1C Hillsboro, OR 97123