Health insurance is a critical aspect of financial planning and ensuring access to quality healthcare. When it comes to choosing the right health insurance plan, individuals and groups often have different options. In this article, we will explore the key differences between individual health insurance and group health insurance to help you make an informed decision.

How does group health insurance work?

Group health insurance, also known as employer-sponsored coverage or group coverage, is a type of health policy procured by an employer and extended to eligible employees and their dependents. Currently, nearly 159 million Americans are beneficiaries of employer-sponsored health insurance.

When opting for group coverage, you have the option to exclude part-time employees from access to these benefits. However, if you choose to include some of your part-time staff, you must make the coverage available to all eligible part-time employees.

Additionally, thanks to the Affordable Care Act (ACA), individuals with pre-existing health conditions cannot be refused coverage, charged higher premiums, or affect the group’s eligibility.

Here’s how most group health insurance plans typically work:

- Employers select one or more plans to offer their employees.

- Plans usually require a 70% participation rate among employees.

- Group members can choose to enroll in or decline employer coverage.

- If they opt for coverage, they do so during the annual open enrollment period or a special enrollment period triggered by a qualifying life event.

- The cost of group health premiums is shared between the employer and participating employees, distributing the risk across the group to reduce costs.

- Family members and dependents can be added to group plans for an extra fee.

- Enrolled employees pay a monthly premium to maintain their medical coverage, typically on a pre-tax basis, deducted from their paycheck.

When it comes to group plans, there are essential terms to be aware of. Depending on the chosen group plan, employees may have a high, low, or zero deductible. They must satisfy their deductible before coinsurance begins and reach their out-of-pocket maximum before their health insurer covers 100% of their medical expenses for the remainder of the plan year.

How does individual health insurance work?

Individual health insurance, also referred to as employee-sponsored coverage, is a health insurance policy that individuals procure independently without assistance from an employer or a federal government program like Medicare or Medicaid. Individual plans encompass both single health coverage policies and family coverage.

Individuals can purchase their medical plan through either a public or private health exchange. The most prominent public exchange is the federal health insurance marketplace, although state-based marketplaces also exist. Private exchanges involve directly purchasing an individual plan from health insurance companies or with the assistance of an insurance agent or broker.

On public exchanges, premium tax credits and other cost-saving subsidies are available to those who qualify based on their income. The policy remains with the individual employee until they choose to cancel it—it is not tied to their employment.

Apart from these distinctions, individual health insurance plans operate in a manner similar to group plans. Like group policies, insurers cannot reject health insurance coverage based on pre-existing conditions. Policyholders make monthly premium payments to maintain coverage, pay a deductible, copay, and coinsurance according to their plan’s coverage level, and also have an out-of-pocket maximum.

Comparing Group and Individual Insurance

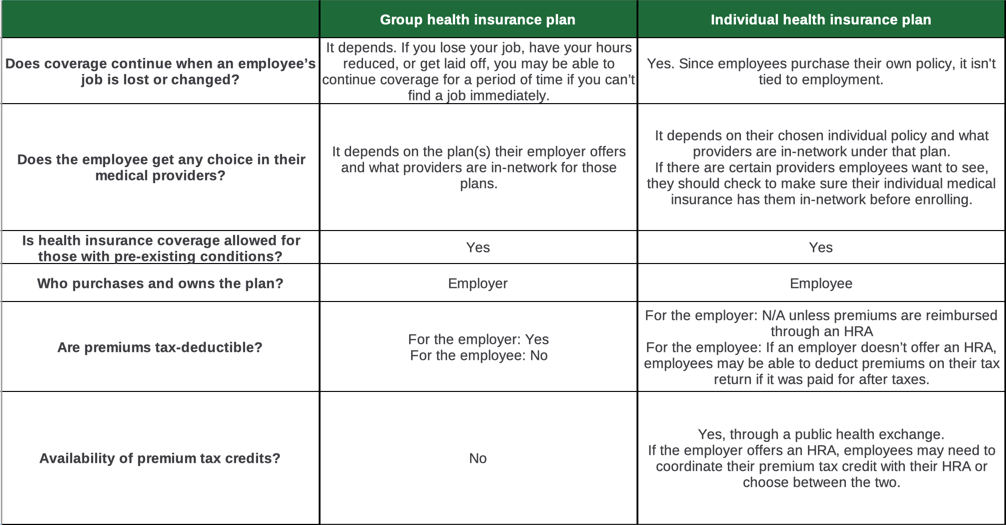

To simplify the comparison, the table below outlines several key aspects where group health insurance differs from individual health insurance, considering both employers and employees.

Comparing the Average Costs of Group and Individual Health Insurance Policies

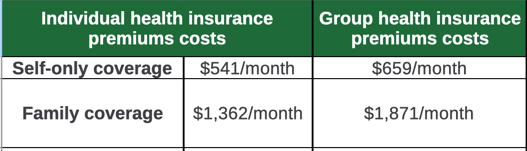

For the year 2022, here are the average premium expenses for individual and group health insurance plans:

Individual health plans, on average, not only come with lower costs than group health plans but also contribute to reduced administrative burdens for employers when employees independently acquire and oversee their own plans.

Ready to start a plan? Call us (971) 233-3637. Our assistance is at no cost to you.